Investing Books: Theory v. Reality

Who really knows how to invest? I trust those who practice what they preach.

When it comes to the world of investing, everyone seems to have an opinion. Some tell you “you can double your money every year with little to no risk” (in my experience, these all tend to be frauds, if you need proof just watch a few episodes of American Greed). Some tell you all you need to do is invest in index funds and you’ll beat the majority of professional investors (While this is the more intelligent way for those with no interest in the market, there are professionals out there who do very well).

For me, investing is a very personal activity. Emotions play more of a role in the investment game than intelligence. You can learn all there is about investing and perfect your understanding of the math, but if you aren’t able to fully understand yourself you will lose. It is for this reason that the books I cover over the next year or two will be a mix of three different aspects of the investing game:

The theory behind investing. These books will primarily revolve around how to value stocks, how to find investments to consider, and how to build financial models to conservatively value companies using all available information. I’ve spent a good portion of the last year building a reputable library of books by seasoned professionals and will be using these as my basis for this group.

Business fundamentals. It’s sometimes easy to forget that the stock tickers represent actual operating businesses. Having operated very low margin businesses for much of the past two years, it’s dawned on me the importance of understanding how to operate a business effectively, even as a passive investor. The more you can understand about business fundamentals, the better one can be as an investor in any business and the more you are likely to make.

Building a psychological edge. When it comes to investing, one of the more integral aspects is to know when to buy or sell, and most of an investor’s understanding of this topic will depend on their ability to weather the volatility of the markets. As investors, we need to both master our emotions and be cognizant enough to understand when we are letting them control us. This category will also include books where the focus is growing out of a scarcity mindset and into a growth mindset, as I’ve found this to be a prevalent reason why most investors do not find success in their chosen field.

Looking at these topics you may ask how we can know which books to read. For me, this answer has always come down to whether the author practices what they preach.

My realization on this topic came during my time in the MBA program. I had signed up for a class on investment valuation and was looking forward to it being as transformational as Warren Buffett’s first class was when he learned from Benjamin Graham at Colombia. I remember walking in and sitting down in the front row and watching the professor as he prepared to deliver what I expected to be a life-changing lecture.

After about 20 minutes of explaining the importance business valuation held in market research and analysis, and listing all of the successful investors who have used it to make large fortunes for themselves and others, he then proceeded to tell the entire class “but don’t take those examples to heart. None of you are as smart as they are so using this in the real world is a waste of your time. You’re better off just indexing.”

I’m not saying I took his words to heart, but I did do my best to prove them wrong. The market is extremely hard to beat, and there’s very few who have done so over the long haul.

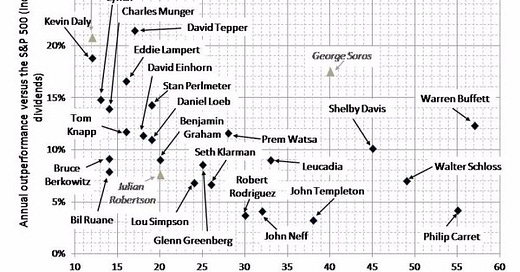

As the following image indicates, not only is it difficult to beat the market, but those who do end up beating it for a long period of time usually see their alpha (meaning excess returns) dissipate as time goes on.

With all that has been said, the question then comes down to “which books should I read to understand this discipline?” and “who should I trust to teach me?” My simple answer to these questions are trust those who have done it, and who are coincidentally listed in the above image. Whatever you do, don’t trust academics to teach you (unless they have a proven track record of outperformance themselves).

I’ve listed some of the investment books that I will be covering throughout the next year below and have included their authors’ track record where appropriate. You’ll find that many of the best investors have spent a considerable amount of time writing in the hope of other investors following in their footsteps. As most say, emulation is the purest form of flattery, and most excellent investors desperately want others to understand their way of thinking.

Books:

The Alchemy of Finance - George Soros (18% outperformance for 40 years)

Security Analysis - Benjamin Graham (9% outperformance for 20 years)

The Intelligent Investor - Benjamin Graham

Poor Charlie’s Almanack - Charlie Munger (14% outperformance for 14 years)

Margin of Safety1 - Seth Klarman (7% outperformance for 26 year)

You Can be a Stock Market Genius - Joel Greenblatt (28% outperformance for 20 years)

One Up on Wall Street - Peter Lynch (14% outperformance for 14 years)

Investing for Growth - Terry Smith (6% outperformance2 for 10 years)

Accounting for Growth - Terry Smith

Fooling Some of the People All of the Time - David Einhorn (12% outperformance for 18 years)

Some of these books focus on growth, others on value. As Charlie Munger’s approach to Berkshire Hathaway has shown, it is best to understand both schools of investing, as a combination of the two factors in any one investment can produce massive amounts of growth.

There are many other books I will be reading, but these are just a few I wanted to list. I’m hoping as I read these and share my thoughts here, we are all able to benefit. If you have any books that you have found useful in your pursuit of knowledge of any kind, do reach out and let me know what they are. I’m always looking for the next good book to read and hope to continue this routine for many years to come.

I look forward to sharing my thoughts and insights with you all over the next year.

Best,

George

Margin of Safety by Seth Klarman is perhaps the only book on this list I would not recommend buying unless you have a deep love for Value Stocks and their analysis. This has been a book I’ve spent the better part of the last decade saving for and was finally able to convince my wonderful wife to purchase (using many of my remaining birthday and Christmas gifts as tribute). As it is likely out of many individuals’ ability to purchase (currently going for $3,730.90 on Amazon) I am hoping my notes and thoughts on my reading give you a broad understanding of what it teaches.

A note on performance: Some of you may be looking at the above groups and wondering “why would a 6% outperformance over the index give any investor any degree of fame?” To frame it as an example, suppose you invested $100k into the index and achieved a 10% rate of return over 10 years (the shortest in the above list) and in that same timespan Terry Smith was able to achieve a rate of return of 16%. How would your portfolios differ over that time period?

At the end of that 10-year period, the same investment in Terry Smith’s portfolio would be 1.7x larger than that of the index (441k vs. 259k). Taking this out to a period of outperformance lasting for 40 years, that difference grows to 8.3x the value of the index portfolio (37.8m vs. 4.5m). This shows that even small outperformance numbers produce very large absolute returns over the long term

Using the most prolific outperformance in the list above (because I know some of you would want to know) Joel Greenblatt’s 28% outperformance for 20 years resulted in a 100x larger portfolio in year 20 than that of the index, ending at 62m compared to the index’s 672k. That is the power of compounded interest.